The Complete Guide to Supplemental Unemployment Benefits

-

1. What Is A SUB Plan?

A Supplemental Unemployment Benefits Plan (SUB Plan) is smart alternative to traditional severance. It is an IRS approved, tax-exempt vehicle used by employers to maintain weekly income for permanently or temporarily displaced employees while generating considerable cost savings for the organization.

2. How SUB Plans Work

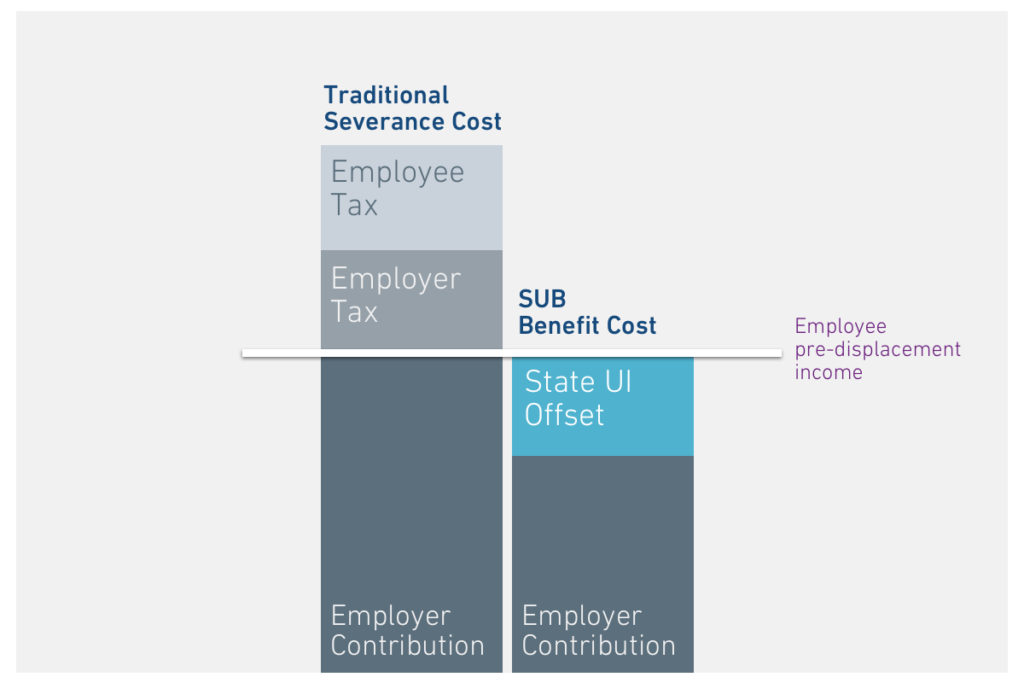

Under a SUB Plan, the employer-paid severance benefit is offset by the amount of State Unemployment the employee is eligible to receive. Displaced employees maintain their pre-displacement wage, while employers save 30-50% when compared to traditional severance.

Savings attained by a SUB Plan are generated from three sources:

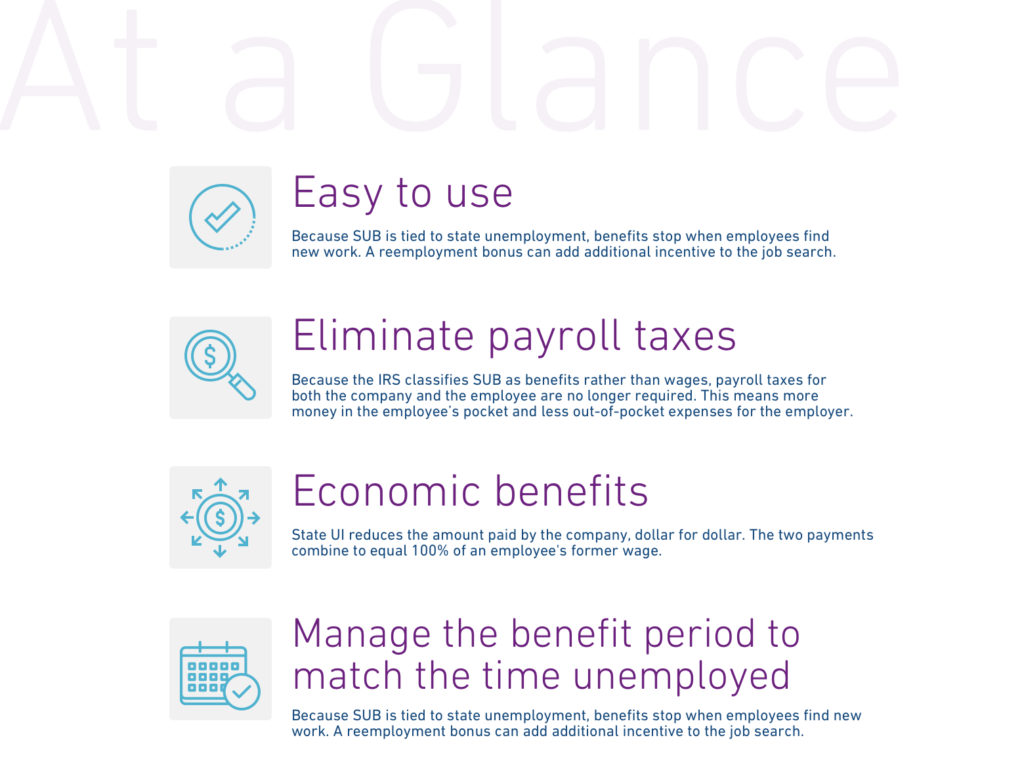

Elimination of Payroll Tax: Under a SUB Plan, separation payments are treated as “benefits” rather than as “wages,” and are thus exempt from the payment of payroll taxes (FICA, FUTA, and SUI) for both the company and the benefit recipient. This reduces the benefit costs for the employer while ensuring slightly increased take-home pay for the displaced employee.

Integration with State Unemployment Insurance (UI): The displaced employee’s income is maintained, but now comes from two sources, employer-sponsored SUB-pay and state UI benefit, thus reducing the benefit cost for the employer on a dollar-for-dollar basis.

Duration Management: SUB Pay acts as a bridge to a released employee’s next opportunity. Because SUB pay is tied to the employee’s eligibility for State UI, payments cease when a displaced employee obtains new employment. An employee may receive a “reemployment bonus” of some percent of the remaining benefit allotment as a taxable bonus. Reemployment rewards a displaced employee for finding new work prior to the expiration of their benefit period while still creating savings for the employer.

Typically, organizations that implement a SUB Plan will save between 25-50% when compared to traditional severance plans. SUB-Plans present a win-win solution to the challenges presented by a reduction in force.

3. History of SUB Plans

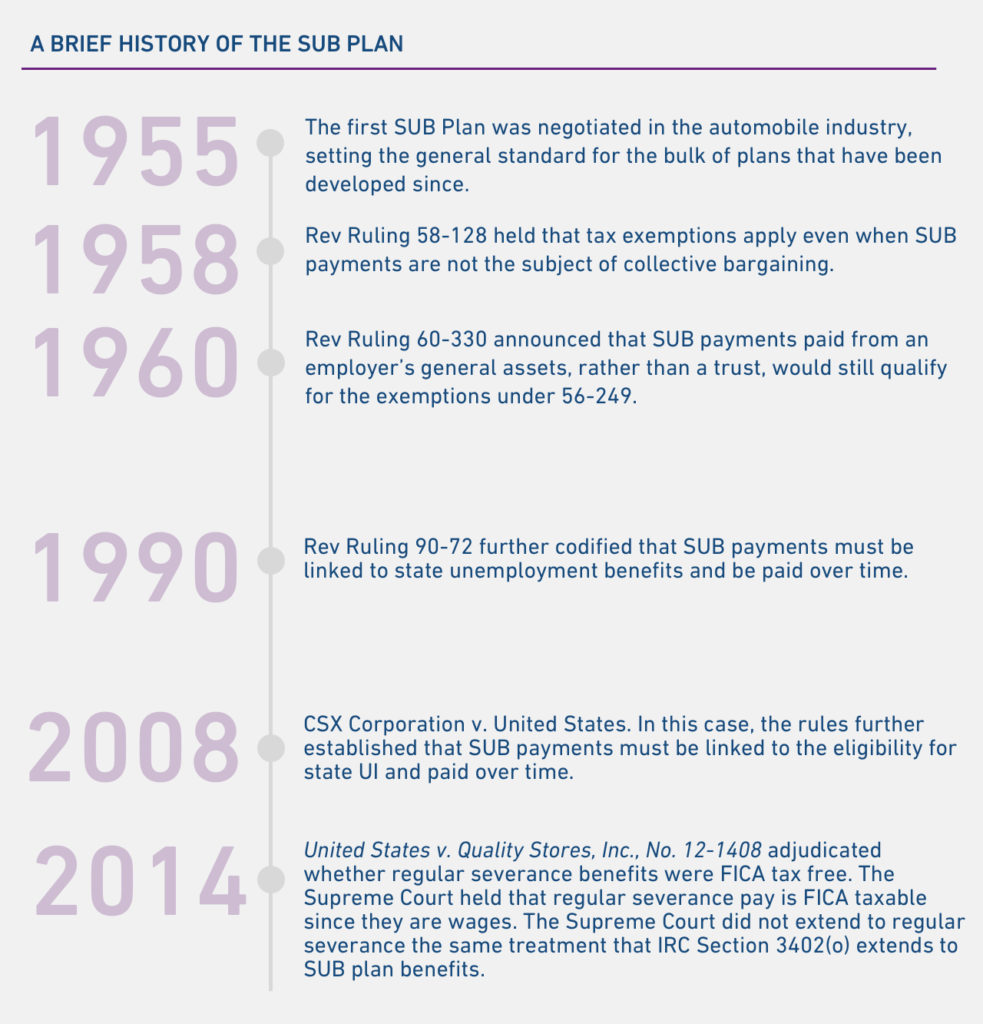

The Supplemental Unemployment Benefits Plan was initially created in the 1950s as a way to provide a more meaningful benefit to individuals affected by reductions in force, as state unemployment benefits were often inadequate to support displaced workers and their families during times of layoffs.

Unions, especially in the auto and steel industries where seasonal and cyclical layoffs are common, advocated for supplemental pay to lessen the disparity between their former wage and the state Unemployment Insurance (UI) benefit. However, because many states disallow individuals from receiving state UI while collecting “wages,” the receipt of supplemental wages would thereby disqualify individuals from receiving the state benefit that the supplemental wages were meant to supplement in the first place.

To adjust for this, the IRS made a correction to the definition of “wages” so that it excluded SUB pay. SUB pay was reclassified as a “benefit” which can be collected in conjunction with State UI and by definition is payroll tax exempt for both the employee and employer.

For many years, the Supplemental Unemployment Benefits Plan was used mainly in the union and collective bargaining environment. Due to the often complicated administration requirements, it is only in the last 20 years that employers within other industries have discovered its value through using 3rd party providers, like TSI, to set up and administer their plans. Today, SUB Plans are offered by all types of employers to any type of W-2 employee.

4. Benefits of SUB Plans vs. Traditional Severance

There are several benefits to both employers and employees when comparing SUB Plans to traditional severance packages. To make an informed decision about which program is a fit for an organization, it’s essential to understand the nuances of the two programs.

Taxes

As discussed above, SUB Plans are not subject to FICA taxes when administered properly. The employer saves 7.65% on the SUB payments it makes, and the employee also benefits from their 7.65% of tax savings, increasing the total take-home pay a released employee receives.

Cash Flow

Traditional severance plans can come in lump sum or periodic payment plans. From a purely HR perspective, it may seem like a generous option to make a lump-sum payment at the time of separation. That said, fiscal prudence often dictates that payments made over time are easier for the employee to manage. As such, while a lump sum payment may seem beneficial in the short term, in the long-term it can create a stressful situation for an employee struggling to budget for the coming weeks. SUB Plans are always administered over time. They’re an efficient way for organizations to manage cash flow and set displaced employees to succeed during an unemployment period.

Better Terms

With a traditional severance plan, employers are responsible for payment of the full amount, regardless of the duration of unemployment. SUB Plans, however, differ from this in two ways. For one, the SUB Plan payment structure leverages state UI and the employee’s weekly pay in order to maintain the employee’s income while unemployed. For example, if an employee’s pay had been $800 per week prior to termination, and was eligible to receive $400 per week in State UI benefits, the employer would only be responsible for the difference of $400.00 per week. In the most efficient version of the plan, payments cease when an employee finds new employment.

Combined, these advantages help to better transition displaced employees to their next employment opportunity. Meanwhile, employers get the advantage of cost savings and a reduced burden on cash flow.

5. SUB Plan FAQ

When Should I Consider Implementing A SUB Plan?

It’s always a good time to consider implementing a SUB Plan. Whether you don’t have any layoffs planned, have an upcoming reduction in force, or are currently in the process of transitioning employees, the nature of SUB Plans means that exploring them as a possibility in the future is always a good idea.

Blog Post: When To Consider Implementing a SUB Plan

Are SUB Plans only for permanent Reductions-in-Force?

In addition to permanent reductions-in-force, SUB Plans offer a valuable solution to temporary furloughs and operational downtimes. During downtimes, a SUB Plan allows employees to maintain a secure, reliable income and remain ready and available to be called back to work while also generating impactful cost savings for the employer. For companies who face retention challenges because of operational fluctuations, a SUB Plan can be the key to retaining talent within a finite budget, and achieving the ability to guarantee a steady, reliable workforce season after season.

I have never heard of a SUB Plan. Why?

Severance and Separation Benefit Plans are typically treated as confidential information, and thus it is predictable that people who have not worked for a company with a SUB Plan are unaware of its existence.

The SUB Plan structure was conceived and implemented in the 1950’s manufacturing environment for use with union workers. SUB Plan administration is easily accomplished in the union environment, however, it is far more difficult in a non-union workplace given the resources required to ensure compliance. It was not until the early 2000’s after third party benefits administration became popular, that SUB Plans began to spread more widely.

Is a SUB Plan a fit for my organization?

The most important aspect of a company’s severance plan is that it fit the company’s culture. For instance, if your organization subscribes to an entitlement culture, paying out a lump-sum windfall in amounts correlating to job level might make a lot of sense. Alternatively, within a finite compensation and benefits budget, this kind of windfall to an employee walking out the door may very well cost retained employees their raises, bonuses or a health-care enhancement. Organizations with a cost-containment culture and pervading commitment to the bottom line likely would benefit from a more practical and economical severance plan design such as a Supplemental Unemployment Benefits Plan.

Do employees still have to file for State UI?

Yes, employees still have to file for State UI. However, the entire process can be done online.

Is this legal in my state?

Yes! Unlike traditional severance payments, all 50 states allow released employees to collect state unemployment benefits and company-sponsored SUB payments concurrently.

My organization doesn’t have any layoffs planned. Why should I do this?

It’s important to begin the SUB Plan implementation process before layoffs occur. After a reduction in force has been announced, it’s often too late to change your severance policy. A neutral time is the best time to evaluate the policy and consider implementing a SUB plan. This ensures the best possible outcome for both the employee and employer when an RIF does happen.

Isn’t this a lot of administrative work for me?

No! Working with a 3rd party like Transition Services puts the administrative work in the hands of the experts.

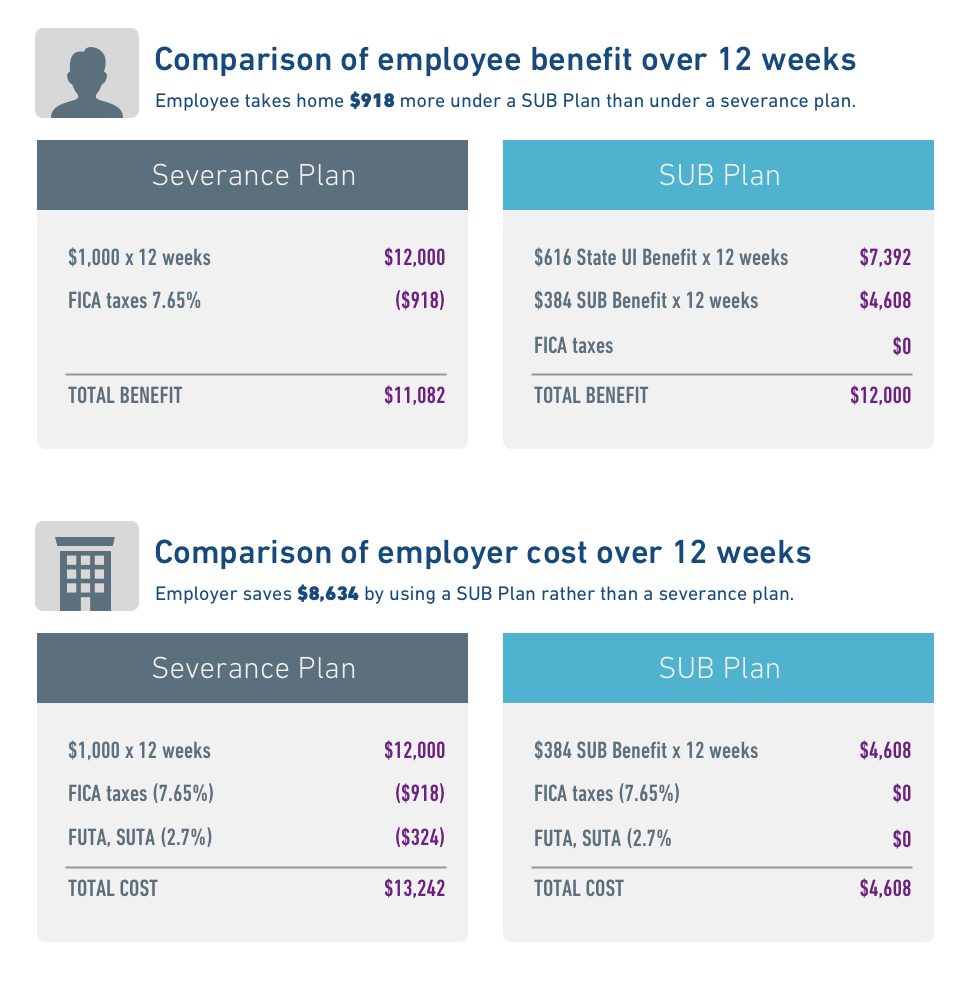

6. SUB Plan Example

An employee with a weekly base pay of $1,000 is temporarily laid off because of a 12-week work stoppage. Under a SUB Plan, the employee applies for state unemployment compensation benefits and is eligible to receive $616 per week. The company then supplements the difference by paying the gap of $384. Together, the two benefits equal 100 percent of the employee’s regular wage. Additionally, neither party is obligated to pay Federal Insurance Contributions Act (FICA) taxes on the payments, which slightly increases the company’s savings while also slightly increasing the employee’s take-home pay. As shown in the following figure, over a 12-week SUB Plan benefit period, the employee’s income is increased by $918, while the cost to retain the employee reduced by $6,042 compared to traditional salary continuation.

7. Implementing a SUB Plan

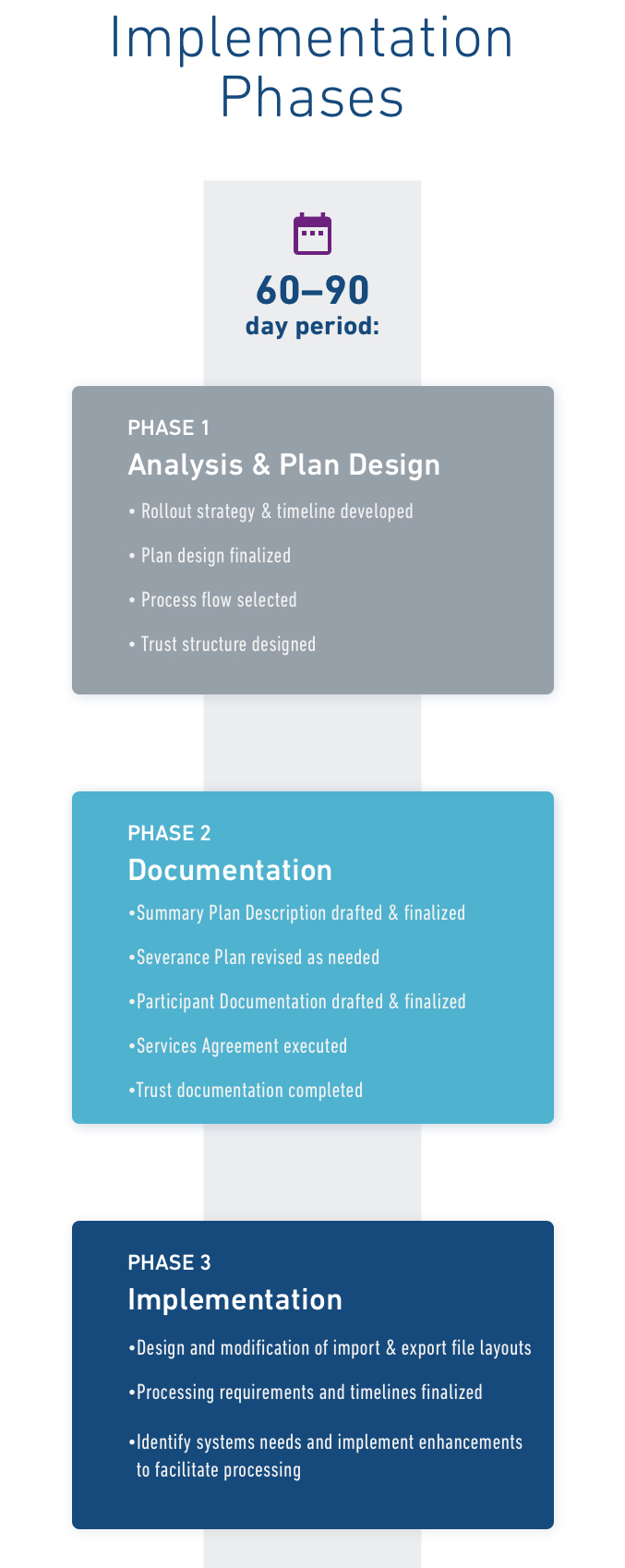

Because of the relatively high administrative burden associated with SUB Plans, companies that choose this option typically engage a third-party administrator to track state regulations, state unemployment claims and employment status of participants, as well as to communicate with released employees and calculate ongoing benefit payments. The cost of using a third-party administrator is a small fraction of the savings achieved through the use of a SUB Plan. Here’s an example of what the TSI SUB Plan implementation process looks like: